We also offer a single calculator which enables you to see at a glance all 3 payment types: fixed, ARM & IO. For example, if you had a 3-1 IO loan that converts to a fixed amortizing loan at prevailing rates in 3 years you would use the IO calculator to calculate the payments for the first 3 years & then use our fixed-rate calculator to calculate the monthly payments for a 27-year loan. If you obtain an interest-only ARM then you could use our IO calculator for the initial term & then conduct a second calculation using either the above ARM calculator or our fixed-rate mortgage calculator to estimate payments after the interest-only period is only. While this calculator allows for changes in interest rate over the life of the loan, all payments are structured as amortizing payments based on the remaining loan term.

Loan contracts with adjustable rates also contain the following limits: Many borrowers who take out an adjustable-rate loan typically intend to refinance their loan into a new ARM or a fixed-rate loan before the initial fixed-rate period ends & rates reset higher. If LIBOR increased or fell by a half-point then so would the rate charged to the borrower. That rate would stay in place until the date of the next reset. For example, if LIBOR is a 4% and the margin is 2% it would mean the rate charged on the loan when it resets would be 6%.

A loan which is called a 5/1 ARM would mean the initial rate on offer would last for 5 years before interest rate resets, and then rates would reset annually thereafter based on the performance of a reference indexed rate upon which a margin is added. Most adjustable-rate loans in the United States are structured as amortizing loans with a hybrid aspect where the rates are fixed for a 3, 5 or 7 year period & then reset periodically after the initial fixed-rate period. Fixed-rate loans may charge slightly higher interest initially, but as inflation builds in the economy over decades & wages increase with inflation it is easier to make the monthly payments. Most homeowners in the United States pick fixed-rate loans to lock in a guaranteed monthly payment level for the life of the loan. The following reference table compares years to months for common hybrid ARMs.

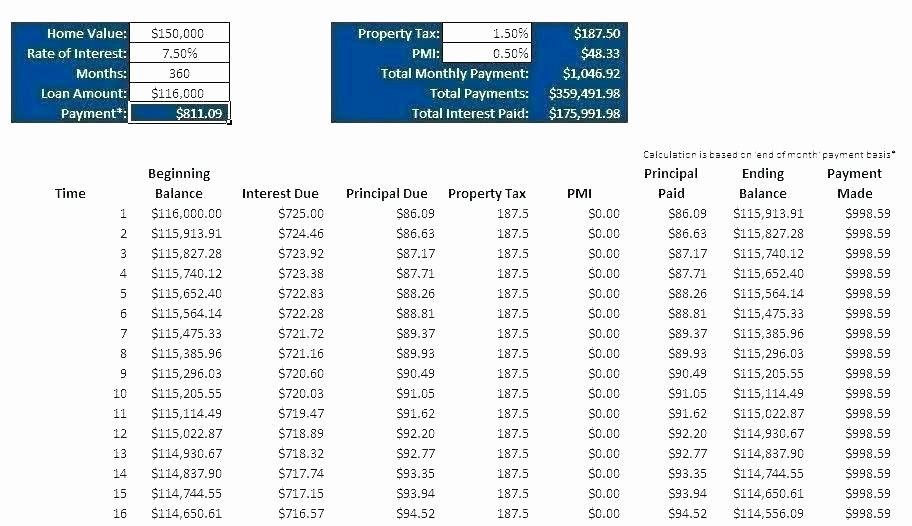

Results will show your core monthly principal & interest payments, along with your all-inclusive payment that includes other mandatory costs of homeownership like property taxes & homeowners insurance.Īt the bottom of the calculator there is a button which enables you to create a printable amortization schedule for the principal & interest payments on your loan, enabling you to compare your actual payments to your initial estimates. This calculator will then automatically calculate your monthly payments throughout the loan term based on whatever assumptions you enter. Enter your initial rate (also known as teaser rate), how long your initial fixed grace period is, how much you expect your load to adjust on the first adjustment, how frequently your loan adjusts after the initial adjustment & the estimated interest rate shift you expect on subsequent adjustments.

0 kommentar(er)

0 kommentar(er)